2 October 2015

Brought to you by Investec Switzerland.

Global markets

Despite equity markets biggest surge in three weeks, global equity markets headed for their worst quarter since 2011 with investors rattled by China’s economic slowdown, uncertainty over Federal Reserve policy and growing pessimism about corporate earnings.

European and US markets continued their retreat early this week on deepening concerns around China’s economy after weaker than expected industrial profit data hit prices of key commodities. The respite from the global equities sell-off proved short-lived as US stocks struggled to add to an end-of-quarter rally after an oil-led advance in commodities faded. Data on Thursday signalled a stabilisation in Chinese manufacturing and markets rebounded while American output stagnated in September amid a stronger dollar and faltering overseas markets.

Emerging Markets fluctuated throughout the week under high volatility; Chinese stocks tumbled in Hong Kong, with the benchmark gauge heading for its steepest quarterly loss in 17 years and the Shanghai Composite Index showing the worst quarterly performance of any major index globally with a contraction of 29%. Investors continue to scrutinise economic data out of the US for further clues on the Federal Reserve’s rate hike schedule. Friday’s Non-Farm Payrolls will be this week’s most eagerly awaited release.

Swiss market

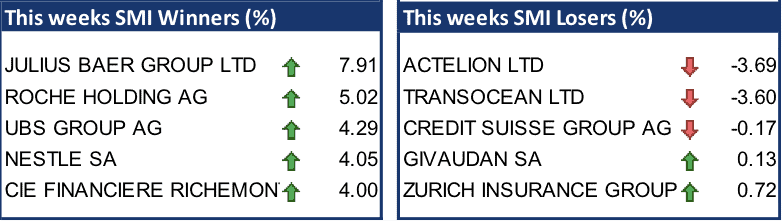

The Swiss Market Index recovered from its losses early this week and outperformed global equity markets significantly led by its defensive heavyweights Nestlé and pharmaceuticals but also cyclical financials. In economic data, the Swiss UBS Consumption Indicator showed the fifth consecutive rise in consumption as employment growth underpinned spending. The announcement of the KOF economic barometer showed a minor decrease in September, which indicates that the outlook for the Swiss economy remains unchanged since the previous release of the barometer in August. However, in terms of GDP, KOF now expects an increased average growth rate of 0.9% (June: 0.4%) for the current year and 1.4% for 2016 (June: 1.3%) as the “Swiss franc shock” and slowdown in Emerging Markets affected the Swiss economy less than previously expected.

Click here for full weekly market roundup.

For more stories like this on Switzerland follow us on Facebook and Twitter.